Adjustable Rate Mortgage (ARM) in Canada

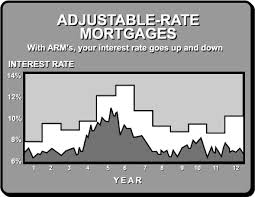

An Adjustable Rate Mortgage is a long-term home mortgage that features an adjustable interest rate. Its counterpart, the fixed rate mortgage, has a predetermined mortgage rate that spans the life of the mortgage repayment time. These mortgages are often referred to as Variable Rate Mortgage or as Renegotiable Rate Mortgage. An ARM in Canada will … Read more