An Adjustable Rate Mortgage is a long-term home mortgage that features an adjustable interest rate. Its counterpart, the fixed rate mortgage, has a predetermined mortgage rate that spans the life of the mortgage repayment time. These mortgages are often referred to as Variable Rate Mortgage or as Renegotiable Rate Mortgage.

An Adjustable Rate Mortgage is a long-term home mortgage that features an adjustable interest rate. Its counterpart, the fixed rate mortgage, has a predetermined mortgage rate that spans the life of the mortgage repayment time. These mortgages are often referred to as Variable Rate Mortgage or as Renegotiable Rate Mortgage.

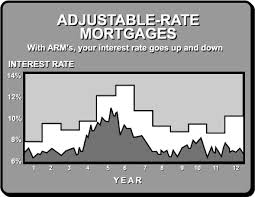

An ARM in Canada will be set up like a regular bank loan but the interest rate can be adjusted at specified intervals by the lending institution. It will start with the current market interest rate and will be adjusted periodically to suit the rising or falling trends of the standard market interest.

If the interest rate falls, then you will enjoy the benefits since your monthly interest rates will be lowered, however, if the interest rate goes up, then it is the lender who will enjoy a much higher interest rate.

In Canada, most consumers tend to prefer having a contract with the lowest initial rates since these rates will be locked in for a specified amount of years. An Adjustable Rate Mortgage usually allows the borrower to pay a lower initial interest rate but you also assume the risk of interest rate fluctuations being applied to your loan after the “safe period” has expired.

While the decision is yours to make, many lending institutions are in favor of ARM’s because of the structure of the financial market. Adjustable Rate Mortgages are the most popular form of home mortgages in Canada for the purchase of new or uses homes since they tend to be less costly than their counterpart, the fixed rate mortgage plans.

We can help you to take all the different types of mortgages available to you and examine them thoroughly in order to choose the right plan for purchasing your new home.