16

Dec 2013Types of Mortgages Available In Vancouver

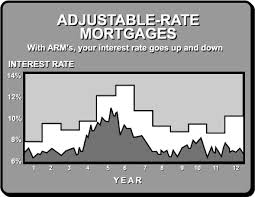

If you are planning to purchase a house with a mortgage in Vancouver, you should have a basic understanding of the different types of plans available to you. We will discuss each one in detail in future posts. Conventional Mortgages These mortgage plans are also known as Low Ratio Mortgages and require a down payment of 20% or more of the total purchase price or…